Maximize your Returns: Invest with PropertyWize Realty

Did You Know?

We buy houses using private investors as our banks and share the profits with them. Our private investors get a fixed return through notes and mortgages secured by real estate. They can use funds from savings or even retirement accounts (IRA’s, 401(k), etc). It's a smart, secure, and profitable way to invest in the future of real estate.

Flat Roof Issues in Baltimore City: Preemptive Measures for Effective Repairs

As homeowners and property managers in Baltimore City, we understand the unique challenges of maintaining and repairing flat roofs, which have become a popular roofing solution due to their aesthetic appeal and space-saving characteristics.

Flat roofs, while visually striking, are particularly challenging in a city prone to extreme weather conditions. Issues such as water pooling, leaks, and material degradation can pose significant threats to the integrity of these roofs. Therefore, adopting preventive measures to address and forestall potential damages is imperative.

Common Challenges with Flat Roofs:

Pooling Water: Unlike pitched roofs, flat roofs lack a natural drainage slope, leading to water accumulation and ponding. In Baltimore's variable climate, with heavy rains and occasional snow, standing water can accelerate roof deterioration.

Leakage: Improper installation, aging materials, or damage from extreme weather can result in leaks. These leaks often manifest as water stains on ceilings or walls, threatening the building's structural integrity.

Material Degradation: Baltimore's weather, characterized by high humidity and temperature fluctuations, accelerates the degradation of roofing materials. UV rays, thermal expansion, and contraction further contribute to material breakdown over time.

Preventive Measures for Effective Repairs:

Regular Inspections: Conduct routine inspections, especially after extreme weather, to identify potential issues early. Check for cracks, tears, or blistering on the roof membrane.

Proper Drainage: Ensure efficient drainage by clearing debris from gutters, downspouts, and roof surfaces. Installing additional drainage systems or creating a slight slope can aid water runoff.

Quality Materials and Installation: Use high-quality roofing materials suitable for Baltimore's climate and ensure professional installation to mitigate premature deterioration.

Coatings and Sealants: Applying reflective coatings or sealants can prolong the roof's life, enhancing its resistance to weathering and reducing the impact of UV rays.

Timely Repairs: Address minor issues promptly before they escalate. This includes fixing small leaks, repairing damaged membranes, or replacing deteriorated sections.

Professional Maintenance: Engage roofing professionals for periodic maintenance. They can comprehensively assess the roof's condition and offer specialized repairs or treatments.

Recommended Annual Inspection and Replacement Schedule:

If your property has undergone roof repairs, we recommend an annual inspection costing $150.00. Also, we would suggest replacing flat roofs every three years, aligning with the standard warranty time frame.

In Baltimore City, flat roof maintenance requires a proactive approach to prevent issues and prolong the roof's lifespan. Regular inspections, prompt repairs, adequate drainage, quality materials, and professional maintenance are pivotal in preserving the integrity of flat roofs amidst the city's varying weather conditions. By implementing these preventive measures, property owners can mitigate the risk of extensive damages and ensure their flat roofs endure the rigors of Baltimore's climate for years.

From all of us at PropertyWize, we wish you & your family a joyful New Year! May this year bring you success, good health, and happiness.

From all of us at PropertyWize, we wish you & your family a joyful New Year! May this year bring you success, good health, and happiness.

Be a Hero! PropertyWize Referral Program

Pick anyone and we’ll manage their property for 1 month for free and yours for free, too.

For Referrals

Only applicable to first time customers. Property also must minimum standards and fully compliant of all state and local laws.

For Current Clients

To qualify, your account must be in good standing. Also only 1 property management fee credit is applicable up to a maximum of $150.00

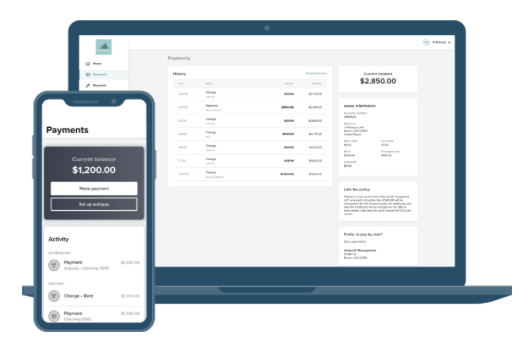

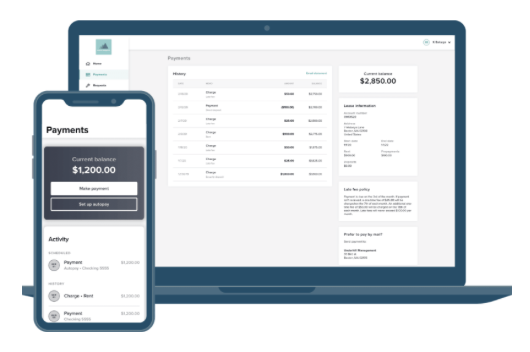

Owner Benefit Package

Minimize Your Exposure... and Headaches:

When a tenant defaults on the rent, it can take months to regain your property and get another tenant in place. Meanwhile, you're continuing to make mortgage payments and incurring additional expenses on the property, all the while losing rental income. Enter the Owner Benefit Package.

Keep Reading

PropertyWize Realty

Enjoy Winter with our exclusive offer:

5% Commission on sales price, along with a generous 30% rebate towards staging cost at closing. Say goodbye to admin fees too!

* For any properties valued over 150K for current or former Property Management clients only.

Interested in Selling Your Property? Contact us now at Sales@PropertyWizeRealty.com!

From all of us at PropertyWize, we wish you & your family a joyful New Year! May this year bring you success, good health, and happiness.

From all of us at PropertyWize, we wish you & your family a joyful New Year! May this year bring you success, good health, and happiness.